Skilled Nursing Facility billing is where hospital complexity meets long-term care regulations. At the center of that complexity sits Revenue Code 0022—the small but powerful signal that tells Medicare, “This claim must be priced under the SNF Prospective Payment System using HIPPS.”

Most SNF denials don’t happen because the patient wasn’t eligible. They happen because the HIPPS code doesn’t match the MDS, the dates don’t line up, or the 0022 line is formatted wrong. One mismatch can delay a claim for weeks in high-volume SNF billing, quietly but consistently destroying cash flow.

This guide breaks 0022 down the way billers actually need it explained—without policy fluff and without textbook theory.

What is Revenue Code 0022?

Revenue Code 0022 is the cornerstone of SNF PPS billing. Unlike ancillary codes such as pharmacy (0250) or therapy (0420), 0022 does not represent a discrete service; instead, it means the base SNF PPS payment under Medicare. Its primary role is to tell the payer:

“Do not price this like a regular fee-for-service claim. Apply the PDPM logic and HIPPS grouping instead.”

Without this revenue code, Medicare cannot correctly interpret the claim, and the payment will likely be delayed or denied.

Meaning

At its core, Revenue Code 0022 signals SNF PPS payment eligibility. It tells the payer that the claim is grouped under PDPM (Patient-Driven Payment Model) and that the corresponding HIPPS code—generated from the patient’s MDS assessment—should dictate the base reimbursement. This single line drives how Medicare calculates the payment for the entire stay, and every other revenue line (therapy, pharmacy, nursing, ancillary services) ultimately attaches to this base payment.

Description

On the UB-04 or 837I claim, 0022 appears as a revenue line paired with:

- A HIPPS code in the HCPCS field

- The service period reflects the SNF stay dates

- The total charge amount associated with the HIPPS category

Unlike ancillary codes, which represent individual billable items, 0022 drives the entire PPS payment logic. Think of it as the anchor line for the claim; all other charges are “hanging” off it for reconciliation

Fee Schedules & Reimbursement Logic

Medicare

Medicare calculates SNF PPS payment based entirely on:

- The HIPPS code generated from the MDS assessment

- The PDPM case mix classification

- The facility wage index

- The length of stay

Importantly, the dollar value of 0022 is not typed in by the biller—it is calculated automatically by Medicare based on these inputs. Accurate HIPPS and PDPM coding is, therefore, essential for proper reimbursement.

Medicaid

State Medicaid programs vary:

- Some states mirror PDPM entirely

- Others use per-diem rates for SNF services

- Therapy may be treated as a carve-out or billed separately

Providers must consult state-specific SNF billing manuals to ensure compliance with 0022 for Medicaid claims.

Private Payers

Commercial insurers may handle 0022 differently:

- Some follow PDPM logic

- Others use negotiated per-day case rates

- Many require pre-authorization to align HIPPS coding with reimbursement

It’s crucial to verify the contract terms and payer-specific rules before submitting 0022 claims to avoid denials or underpayments.

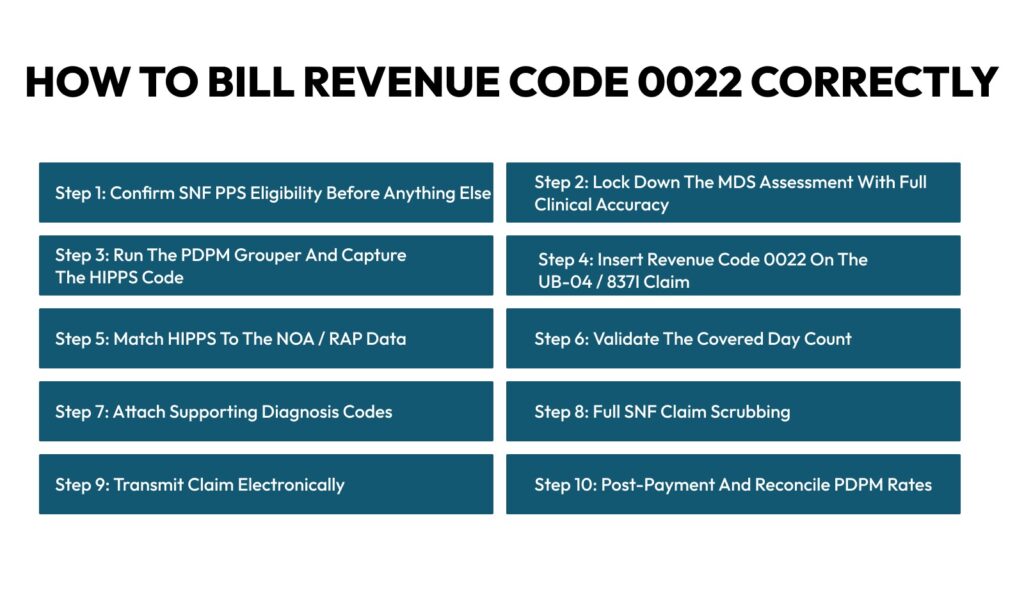

How to Bill Revenue Code 0022 Correctly (Step-by-Step)

Billing Revenue Code 0022 is far more than entering a line on a claim—it’s the financial translation of your clinical documentation into payable Medicare revenue. This code represents the SNF Prospective Payment System (PPS) reimbursement, driven by MDS assessments, PDPM grouping, and HIPPS codes. Any break in this chain—whether in documentation, coding, or claim submission—can result in returned claims, underpayments, or audits. High-performing SNF billing teams follow a strict workflow to minimize errors and maximize reimbursement. Here’s a real-world, denial-proof approach:

Step 1: Confirm SNF PPS Eligibility Before Anything Else

Before touching HIPPS codes or generating PDPM groups, confirm the patient qualifies for SNF PPS billing:

- Medicare Part A coverage: Only patients under Part A are eligible for PPS reimbursement.

- Skilled vs. custodial care: Ensure the admission is for skilled nursing, not long-term custodial care.

- Available benefit days: Verify the patient hasn’t exhausted their SNF benefit days.

- Qualifying hospital stay: For most PPS claims, a preceding hospital stay of at least three days is required.

Even a single eligibility error can invalidate the 0022 claim, resulting in a complete denial despite accurate downstream coding.

Step 2: Lock Down the MDS Assessment With Full Clinical Accuracy

The Minimum Data Set (MDS) assessment drives your PDPM classification, which in turn determines payment. Accuracy here is critical:

- Therapy minutes must reflect actual patient care; overstated or understated minutes can misclassify therapy groups.

- Clinical category diagnoses must be fully captured; missing comorbidities or secondary conditions can reduce PDPM payment.

- Cognitive and functional scoring affect patient grouping and payment weights.

- NTA, nursing, and speech therapy points should be carefully documented, as they affect ancillary payments.

Even a single missed diagnosis or mis-scored function can shift the patient into a lower-paying HIPPS group, reducing reimbursement.

Step 3: Run the PDPM Grouper and Capture the HIPPS Code

Once MDS is finalized:

- Run the PDPM grouper to assign the correct payment group.

- Generate the HIPPS code, which directly links to the PPS payment rate.

- Lock the HIPPS output to prevent inadvertent edits.

Never reuse HIPPS codes from previous stays or manually guess—they must be generated fresh for each patient episode.

Step 4: Insert Revenue Code 0022 on the UB-04 / 837I Claim

Now, billing begins:

- Enter Revenue Code 0022 on your claim.

- Place the HIPPS code in the HCPCS/procedure field.

- Enter the correct service “from” date, reflecting the start of the SNF stay.

- Include total charges for the grouped stay.

Formatting errors at this stage—incorrect dates, mismatched HIPPS, or missing totals—are common denial triggers.

Step 5: Match HIPPS to the NOA / RAP Data

Medicare cross-checks your claim against the Notice of Admission (NOA) or Request for Anticipated Payment (RAP):

- HIPPS on the claim must match the expected HIPPS from the NOA/RAP.

- Any mismatch results in claim returns, delayed payment, or front-end edits.

Always reconcile your final claim with NOA or RAP data before submission.

Step 6: Validate the Covered Day Count

Payment is tied to benefit days, so billing must reflect:

- Covered days billed = actual benefit days available

- Avoid overlapping days with hospitalizations or hospice care

- Align discharge and transfer dates perfectly

Overbilling—even by a day—can trigger automatic denials.

Step 7: Attach Supporting Diagnosis Codes

The 0022 line cannot stand alone. Proper supporting documentation is essential:

- Primary SNF admission diagnosis

- High-weight comorbidities that affect PDPM grouping

- Therapy-related diagnoses for therapy-driven reimbursement

- NTA qualifying conditions

If your diagnosis logic does not match the HIPPS group, audits and recoupments are likely.

Step 8: Full SNF Claim Scrubbing

Before submission, scrub the claim thoroughly:

- Check for HIPPS format errors

- Validate revenue code consistency

- Avoid duplicate PPS billing

- Ensure discharge codes are valid

- Confirm the length of stay is accurate

This scrubbing alone can reduce denials by 25–40%.

Step 9: Transmit Claim Electronically

Send claims via:

- 837I EDI submission

- Medicare MAC clearinghouse

After submission, track:

- Acknowledgment receipts

- Front-end rejections

- Re-submission windows

Promptly address any system feedback to avoid delayed payments.

Step 10: Post-Payment and Reconcile PDPM Rates

After receiving remittance:

- Compare paid amount vs expected PDPM rate

- Investigate underpayments or discrepancies

- Log HIPPS code vs paid DRG

Many hidden revenue losses are discovered at this stage, making reconciliation critical for financial health.

Tips for Providers Using 0022

- Review Therapy Data Carefully: Verify all therapy entries before generating the HIPPS code to prevent mis-grouping.

- Lock HIPPS Codes: Once sent to billing, lock the HIPPS to avoid mismatches from late chart edits.

- Audit PDPM Rate Drops: Monitor monthly payments and investigate unexpected drops to catch errors early.

- Track HIPPS vs Payment Variance: Any difference above 5% should trigger an internal review.

- Train Coders on PDPM Logic: Ensure coders understand how diagnoses, functional scores, and therapy affect payment.

- Validate Transfers and Discharges: Double-check admission, transfer, and discharge dates to prevent claim denials.

Conclusion

Revenue Code 0022 is the heartbeat of SNF PPS billing. It doesn’t just indicate a service—it drives Medicare payment through PDPM and HIPPS logic. A single misstep, whether it’s an incorrect HIPPS code, misaligned therapy data, or an unrecorded discharge date, can trigger denials, underpayments, or extended cash flow delays.

By following structured best practices—carefully reviewing therapy entries, locking HIPPS codes, auditing PDPM rates, and tracking variances between expected and actual payments—providers can protect revenue and prevent costly errors. Maintaining accurate documentation, creating HIPPS change logs, and training coders on PDPM logic ensures claims are compliant, defensible, and properly reimbursed.

In short, precise Revenue Code 0022 billing is not optional—it’s the foundation of financial stability in SNF operations. Providers who prioritize accuracy, validation, and proactive audits will see fewer denials, smoother cash flow, and maximum reimbursement for every patient stay.