Inpatient Rehabilitation Facilities (IRFs) deliver intensive, multidisciplinary care to patients recovering from strokes, orthopedic surgeries, and traumatic injuries. Unlike traditional inpatient billing, reimbursement in this setting is episode-based—and Revenue Code 0024 is the primary indicator that triggers correct payment under the IRF Prospective Payment System (IRF PPS).

Revenue Code 0024 tells Medicare and commercial payers that a claim represents a complete inpatient rehabilitation episode, not a series of daily charges or individual therapy sessions. When applied correctly, it enables bundled reimbursement based on the patient’s Case Mix Group (CMG), therapy intensity, and clinical complexity.

Misuse or misunderstanding of RC 0024 can lead to denials, underpayment, or audit exposure. This guide explains what Revenue Code 0024 means, when to use it, how reimbursement works, and how IRFs can bill it correctly to protect revenue and compliance.

What Is Revenue Code 0024

Revenue Code 0024 identifies inpatient rehabilitation services billed under the IRF Prospective Payment System (IRF PPS) and signals a bundled payment based on the assigned Case Mix Group (CMG).

Meaning

Revenue Code 0024 is used to identify inpatient rehabilitation services billed under the Inpatient Rehabilitation Facility Prospective Payment System (IRF PPS). It communicates that the claim represents a complete inpatient rehab episode, subject to bundled payment based on Case Mix Group (CMG).

Description

IRF PPS reimburses based on patient complexity and therapy intensity rather than per-day-of-stay. The CMG assigned to the patient determines the base payment, which may then be adjusted for comorbidities, age, and other factors. RC 0024 signals to Medicare and commercial payers that the claim encompasses all rehabilitation services, room, board, and ancillary therapy costs associated with the episode.

Example:

A patient is admitted to an inpatient rehab facility for a two-week intensive therapy program. He receives daily PT, OT, speech therapy, and nursing care. The IRF submits a claim using RC 0024, paired with the appropriate CMG code. Medicare reimburses a bundled payment for the episode, covering all therapy and nursing services, because documentation and coding accurately reflect the patient’s complexity and care intensity.

Revenue Code 0023 vs Revenue Code 0024

| Feature | Revenue Code 0023 | Revenue Code 0024 |

|---|---|---|

| Facility Type | IRF (per diem services) | IRF (full PPS episode) |

| Payment Model | Daily or interim charges | Bundled episode payment |

| PPS Indicator | No | Yes |

| CMG Required | No | Yes |

| Units Reported | Per day | Typically 1 per episode |

| Audit Risk | Moderate | High if misused |

| Common Use Case | Interim or non-PPS billing | Final IRF PPS claim |

When to Use Revenue Code 0024

RC 0024 should be used when:

- The patient is admitted to a Medicare-certified inpatient rehabilitation facility.

- Care is reimbursed under IRF PPS rather than traditional fee-for-service.

- The documentation supports medical necessity and therapy intensity for PT, OT, speech therapy, and nursing services.

- The claim represents a full episode of inpatient rehab care, rather than daily charges or isolated therapy sessions.

This code ensures your IRF is fully and correctly reimbursed, reflecting both the patient’s clinical needs and the therapy intensity delivered during the stay.

When Not to Use Revenue Code 0024

RC 0024 should not be used in the following situations:

- The patient is receiving care in a standard hospital unit or skilled nursing facility, rather than an IRF.

- Services are provided only as outpatient therapy.

- The episode does not meet IRF PPS admission criteria, such as insufficient therapy hours or medical complexity.

- Billing is being done for room, board, or therapy under a different revenue code (e.g., 012x for acute care).

Misuse of RC 0024 is a frequent cause of denials. Agencies must ensure that admission, therapy documentation, and CMG assignment all support the claim.

Fee Schedules / Reimbursement Rates

Understanding payer-specific reimbursement ensures accurate revenue projection.

Medicare

Medicare uses the IRF PPS, in which payment is determined primarily by the patient’s CMG. Adjustments are made for:

- Comorbidities

- Age

- Geographic wage differences

Payments are bundled, covering all therapy, nursing, and room/board costs during the episode.

Medicaid

Medicaid reimbursement for inpatient rehab varies by state. Some states follow PPS logic, while others reimburse based on therapy minutes or daily rates. Confirm your state-specific rules to ensure correct billing.

Private Payers

Private insurers often follow the IRF PPS methodology, but may have contract-specific adjustments. Accurate documentation of therapy intensity, medical necessity, and daily patient progress is essential to avoid reduced payments.

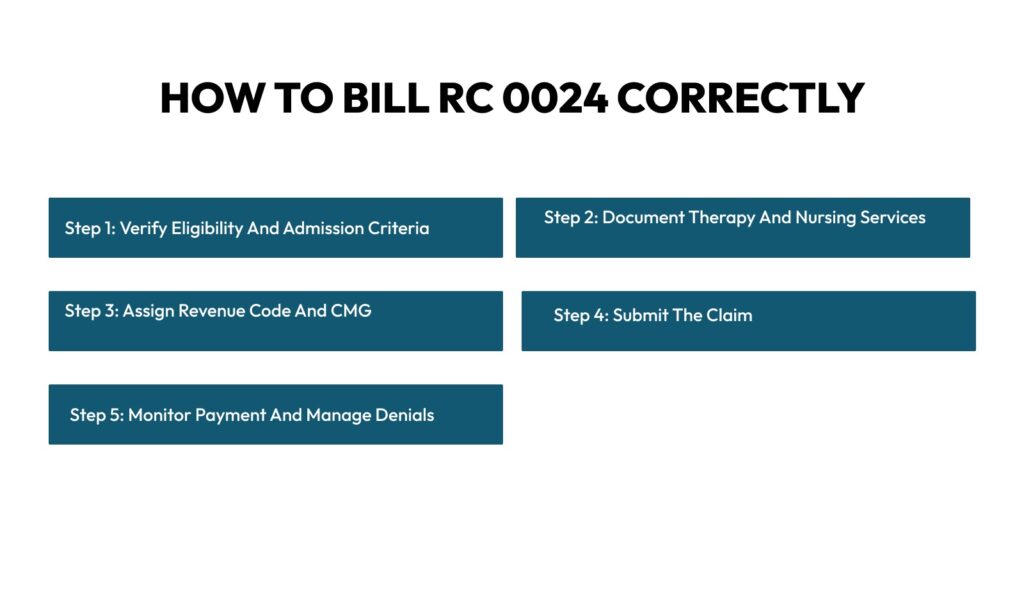

How to Bill RC 0024 Correctly – Step by Step

Billing Revenue Code 0024 requires precision at every stage of the revenue cycle management. Since IRF PPS reimbursement is episode-based and driven by patient complexity and therapy intensity, even minor documentation, coding, or submission errors can delay payments or result in denials. Here’s a detailed, step-by-step approach to get it right.

Step 1: Verify Eligibility and Admission Criteria

Before submitting a claim, confirm that the patient qualifies for IRF services under Medicare or the payer’s policies. This includes ensuring the patient meets admission criteria, such as:

- Medical necessity for intensive rehab

- Ability to participate in at least three hours of therapy per day

- Presence of a multidisciplinary care plan

Verify that the plan of care is signed and physician-certified, and that all pre-authorization or payer requirements are met. Failing to confirm eligibility can result in insurance claim denials or recoupments.

Step 2: Document Therapy and Nursing Services

Documentation is the backbone of RC 0024 billing. Because IRF PPS is episode-based, it’s not enough to note visits—you must record therapy intensity, duration, and clinical progress for each day.

Include:

- Physical Therapy (PT), Occupational Therapy (OT), and Speech Therapy minutes per day

- Nursing and ancillary support, such as wound care, medication management, and patient monitoring

- Functional progress assessments, demonstrating measurable improvements in mobility, self-care, or communication

Step 3: Assign Revenue Code and CMG

Assigning the correct Revenue Code and Case Mix Group (CMG) is critical because it determines the bundle payment for the episode.

- Revenue Code: 0024

- CMG Code: Determines PPS payment based on patient complexity, functional status, and therapy needs

- Units: Typically 1 per episode

Step 4: Submit the Claim

After verifying eligibility, documenting services, and assigning codes, submit the claim:

- Use UB-04 forms or electronic submission portals

- Include RC 0024, the CMG code, ICD-10 diagnosis codes, and any supporting documentation

- Ensure all patient identifiers and NPIs are accurate

Step 5: Monitor Payment and Manage Denials

Submitting the claim is only part of the process. You must track remittance and payment carefully:

- Payment is determined by the CMG, with adjustments for comorbidities and geographic wage indexes

- Denials commonly occur due to insufficient therapy documentation, incorrect CMG assignment, or missing physician certification.

- Conduct weekly audits of submitted claims to catch errors early

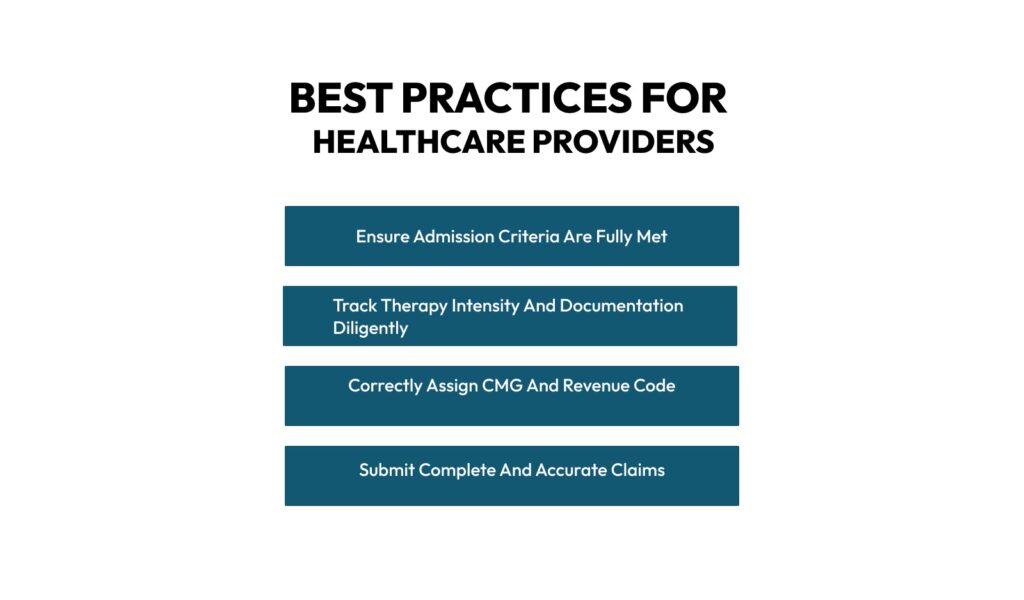

Best Practices for Healthcare Providers

Revenue Code 0024 is the cornerstone for billing inpatient rehabilitation facilities under the IRF Prospective Payment System (IRF PPS). To maximize reimbursement, reduce denials, and streamline your revenue cycle, providers must follow systematic best practices.

Ensure Admission Criteria Are Fully Met

Before billing RC 0024, confirm that the patient qualifies for IRF services under Medicare or applicable private payers. Admission criteria often include:

- Need for intensive therapy (typically at least three hours per day)

- Multidisciplinary care plan with physician certification

- Functional limitations that require inpatient rehab

Track Therapy Intensity and Documentation Diligently

IRF PPS payment is heavily influenced by therapy intensity and patient functional status, so accurate, detailed documentation is critical.

Providers should:

- Record daily PT, OT, and speech therapy minutes

- Log nursing interventions and ancillary support

- Document functional progress assessments that align with the CMG assignment

Use EHR systems to track therapy minutes automatically, but always review them manually to ensure accuracy. Include notes on the patient’s response and progression to support complete medical necessity.

Correctly Assign CMG and Revenue Code

CMG assignment is the financial driver of IRF PPS reimbursement. Always ensure:

- Revenue Code: 0024

- CMG code: Matches patient’s functional status, diagnosis, and therapy intensity

- Units: Typically 1 per episode

Best Practice: Cross-check CMG assignments against therapy logs and ICD-10 codes before submitting claims. Consider regular internal audits to ensure consistency and accuracy.

Submit Complete and Accurate Claims

Even with proper documentation and coding, claims can be denied if submitted incorrectly. To ensure compliance:

- Use UB-04 forms or electronic submissions

- Include RC 0024, CMG code, ICD-10 diagnoses, and supporting documentation

- Verify patient identifiers, NPIs, and admission/discharge dates

Best Practice: Conduct a pre-submission scrub using your billing system or clearinghouse to catch missing or mismatched fields. A single missing diagnosis or date can trigger a denial.

Monitor Payments and Manage Denials Proactively

Submission isn’t the last step. Providers must actively track remittances and denials:

- Review remittance advice to confirm payments align with expected CMG reimbursements

- Investigate and appeal denials promptly, attaching all supporting therapy, nursing, and physician documentation

- Track denial trends to identify recurring issues (e.g., therapy documentation gaps or CMG misassignment)

Best Practice: Maintain a weekly auditing schedule. Quick intervention on denied claims preserves revenue and reduces administrative burden.

Conclusion

Revenue Code 0024 is essential for accurate reimbursement of inpatient rehabilitation episodes. By maintaining thorough documentation, correctly assigning CMG codes, and following meticulous submission processes, IRFs can significantly reduce denials, expedite payments, and ensure the full value of intensive rehab care is recognized. Mastery of RC 0024 allows rehabilitation facilities to focus on delivering high-quality, patient-centered care without the distraction of revenue cycle setbacks.

Streamline your inpatient rehab billing with Medhasty- Medical Billing Services

At Medhasty, we monitor therapy intensity, track documentation in real time, and ensure every RC 0024 claim is compliant, accurate, and fully reimburses you.

Contact us for Inpatient Rehab Billing Solutions.

FAQs

What is RC 0024 used for?

RC 0024 is used for inpatient rehabilitation facility (IRF) episodes under IRF PPS, which bundles reimbursement based on Case Mix Group (CMG), patient complexity, and therapy intensity. It covers PT, OT, speech therapy, nursing, and room/board charges for the whole episode.

Can RC 0024 be used for outpatient rehab or standard hospital stays?

No. RC 0024 is strictly for IRF PPS inpatient episodes. It cannot be used for outpatient therapy, standard hospital admissions, or skilled nursing facility stays. Using it outside of IRF PPS will result in denials.

What documentation supports an RC 0024 claim?

Documentation should include:

- Daily therapy intensity (minutes per day for PT, OT, and speech therapy)

- Nursing and ancillary support

- Functional progress assessments

- Physician certification and plan of care

Tip: Therapy logs and progress notes should match the assigned CMG to avoid payment discrepancies.

How do I determine the correct CMG?

The CMG is assigned based on:

- Primary and secondary diagnoses

- Functional status at admission

- Expected therapy intensity and patient comorbidities

What are common RC 0024 claim denials?

- Insufficient therapy documentation

- Incorrect CMG assignment

- Missing physician certification

- Errors in ICD-10 coding or claim submission

Do private insurers follow the same IRF PPS rules?

Many private payers adopt IRF PPS logic, but may include contract-specific adjustments. Always verify payer rules, confirm episode requirements, and submit supporting clinical documentation to avoid underpayment.

How often should claims and documentation be audited?

Weekly audits are recommended for both RC 0023 and RC 0024 claims. This ensures therapy sessions, nursing notes, and coding align with payer requirements and reduces the risk of denials or delayed payment.